Welcome to the M+ Trading Platform Support Center by StockAngel. Here, Angeline Khoo and the team provide clear, simple tutorials to help you maximize your trading experience. Whether you’re funding your account, placing your first order, subscribing to IPOs, or managing stop-loss settings — you’ll find all the answers right here.

Margin Trading

Margin Trading

What is Margin Trading?

Margin trading refers to a transaction in which you use the securities or assets in your account as collateral and pay the related interest and handling fees to borrow more funds from M+ Global for securities purchases.

How to Perform Margin Trading

1. If you are a new user, please choose a margin account when opening an account. If you already have an M+ Global account and want to open a margin account, you can upgrade your account to a margin account by checking out "Open and Cancel a Margin Account" for more details.

如果您是新用户,请在开户时选择保证金账户。如果您已经拥有M+Global 并希望开设保证金账户,您可以通过查看“Open and Cancel a Margin Account”获取更多详细信息,将您的账户升级为保证金账户。

2. Margin trading: If there are insufficient funds at the time of stock purchase, margin trading will be used by default. 如果在购买股票时资金不足,将默认使用保证金交易。

FX Repayment

When you are trading securities in your financing account, it's gonna use the available cash in the same currency as the transaction. But if your cash is not enough, it's gonna end up in arrears in that currency.

You can sort out those arrears by tapping into the available cash balance from other currencies right in the M+ Global App.

当你在融资账户交易证券时,它会使用与交易相同货币的可用现金。但如果你的现金不够,就会导致相应货币的拖欠。你可以通过在 M+ Global App 中利用其他货币的可用现金余额来解决这些拖欠

i. Repayment steps

Ensure u have available cash balance in other currencies to repay the arrears.

Log in> select currencies to repay the arrears> payment is completed once the client has confirmed the repayment

ii. Details steps

Open M+ Global> click ‘Total Asset’ on the ‘Trade’ bar> click ‘Repayment’> select ‘FX Repayment’> click ‘Repay’> enter the full/ partial amount, select the currency to be used to repay> ‘confirm’> enter trading password> completed

iii. Repayment Types

M+ Global has two repayment types: Manual Repayment and Automatic Repayment

Manual repayment: Repayment initiated by the user when the account is in arrears 用户自己启动还款

Automatic repayment: The system initiates repayment under certain specific circumstances when the account is in arrears. 系统会启动还款

Reminder:

The cash balance of the financing currency will turn negative, and the user will be charged financing interest when the account is in arrears.

Note that interest is usually calculated on a daily basis and settled monthly based on the number of financing days from the deduction date. The exact deduction date is on the date when interest is charged. The cash balance you see before the interest deduction does not include any deducted interest. Arrears may occur and result in a negative cash balance if the cash balance turns zero before the interest deduction.

融资货币的现金余额会变成负数,并且当账户出现拖欠时,用户将被charge融资利息。

请注意,利息通常按日计算,并根据从扣款日期起的融资天数,每月结算一次。确切的扣款日期是计息日期。在扣除利息之前您看到的现金余额不包括任何已扣除的利息。如果在扣除利息之前现金余额变为零,就可能发生拖欠并导致负的现金余额。

Guide to Handling Overtrading and Repayment in Margin Accounts:

Example:

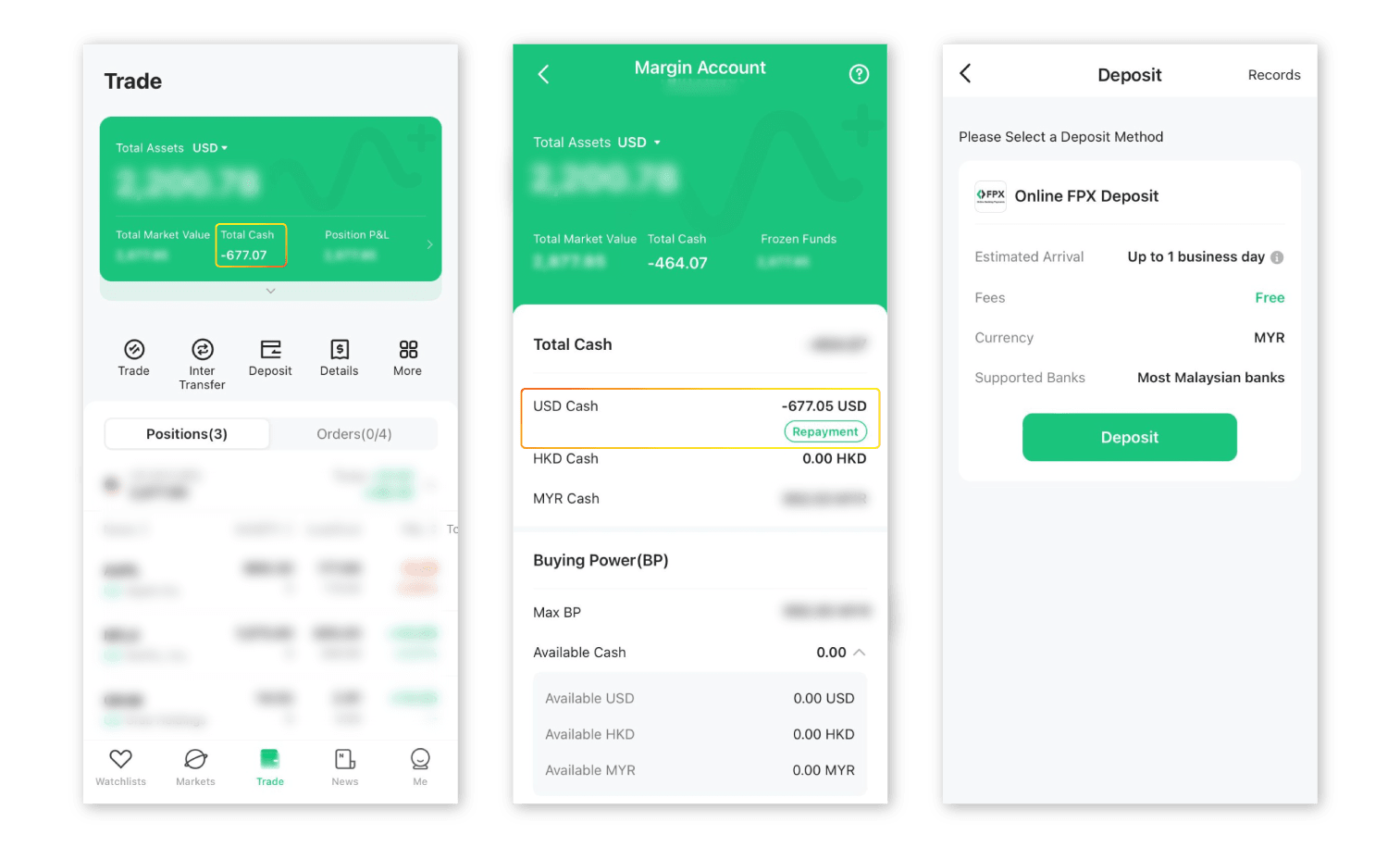

• When overtrading occurs, the 'Total Cash' in the account will become negative.

• In such cases, refer to the highlighted box indicating the negative Total Cash.

• Proceed to the second photo, which shows the margin account page.

• Look for the "Repayment" section on the page.

• Pay the amount of money corresponding to the overtraded value by clicking on the "Repayment" option.

• After clicking, you will be directed to the deposit page to make the necessary deposit.

Fees

Margin Rates: 8% (US & HK)

Commission / Brokerage fee

US stocks fees: Commissions as low as 0.25% / min USD4.88 whichever is higher

HK stocks fees: Commissions/Brokerage fee as low as 0.2% / min HKD25 whichever is higher

Two Situations

1- Margin account but never overtrade:

Means u didn't buy over your cash. Then, you will NEVER get charged for the margin rate.

2- Margin account but you got overtrade:

Means you buy more than the cash you have. Then, you will be charging the margin rate

(depends on how many days you use the margin, then you will be charged for how many days)

Margin Ratio

Please check out "How to view the Margin Ratio of a stock" for more details.

If you haven't opened your M+ Trading Account yet, click here to open one now.

Get in touch with our team

Assistance Hours

Mon – Fr 9:00am – 5:30pm

Saturday & Sunday – CLOSED